Recent

Business

The Role of Office Supplies in Promoting a Positive Work Environment

Along with technology and furniture, office supplies are essential to an entire workplace environment. Using a reliable office supply vendor can provide convenience and cost savings.

Technology

Understanding High Risk Credit Card Processing: A Comprehensive Guide

High-risk credit card processing is a type of payment processing that is designed for businesses that are considered to be at a higher risk of fraud or chargebacks

Health

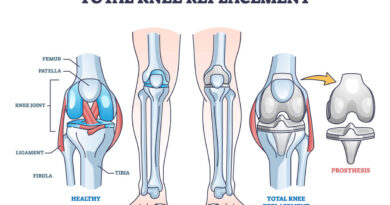

Top 5 Mistakes After Knee Replacement: Skipping Medication

Discover the top Five mistakes to avert after knee replacement surgery. How to optimize your prevent and recover setbacks for a wealthy rehabilitation journey.

Fashion

7 Tips to Dress Your Baby Girl Stylishly

Styling your small girl may be both enjoyable and difficult. On the one hand, it’s an opportunity to dress up your kid in gorgeous clothing and show off their cuteness to the rest of the world. On the other hand, infants grow rapidly, so clothes quickly get too small for them

Travel

Luxury Travel and Oriental Fashion – What’s Hot and Where’s the Best Place to Stay?

This article is about oriental fashion luxury travel When it comes to luxury travel, European haute couture is a very exciting option. It combines Eastern and Western ideas and is available in a range of price ranges.

Entertainment

Top 10 Hottest Sonic Girls: The Sizzling Stars

Top 10 Hottest Sonic Girls, Here’re 10 Top 10 Hottest Sonic Girls that must grace our cover over the years:

Recent Posts

Unlocking the World of Cryptocurrency: How to Earn your First Dollar in Cryptocurrency

Cryptocurrency refers to virtual or digital currencies that make use of cryptographic principles and blockchain generation to facilitate constant and decentralized transactions.